The best alternatives to Vanguard are

- J.P. Morgan Self-Directed Investing - US-based discount broker

- Ally Invest - US stockbroker

- Merrill Edge - US discount broker

- Fidelity - US stockbroker

Let's see in a bit more detail how the Vanguard alternatives compare to Vanguard and each other:

|

Overall score

|

4.3 stars | 4.5 stars | 4.5 stars | 4.6 stars | 4.7 stars |

|---|---|---|---|---|---|

|

Fees score

|

4.1 stars | 4.5 stars | 4.3 stars | 4.2 stars | 3.5 stars |

|

Account opening score

|

4.4 stars | 5.0 stars | 4.4 stars | 5.0 stars | 4.4 stars |

|

Deposit and withdrawal score

|

1.8 stars | 1.6 stars | 1.5 stars | 1.6 stars | 3.8 stars |

|

Web platform score

|

3.4 stars | 2.9 stars | 4.0 stars | 4.3 stars | 4.5 stars |

|

Markets and products score

|

2.6 stars | 2.1 stars | 2.4 stars | 2.4 stars | 3.6 stars |

|

|

Visit broker | Visit broker | Visit broker | Visit broker | Visit broker |

Why are these brokers considered good alternatives to Vanguard? There are many areas based on which Vanguard can be compared with others. When we say a given online broker is a good alternative to Vanguard we mean these brokers are comparable in the following areas:

- The products they offer, meaning you can buy mostly the same things, i.e. stocks, CFDs, options, etc.

- The type of clients they target, i.e. beginners, experienced investors, or day traders.

Vanguard alternatives recommendations

Brokers are different in a number of ways, which means each of them may be suitable for different people. Here's how they compare overall:

- Vanguard is recommended for long-term investors looking for great etf and mutual fund selection

- J.P. Morgan Self-Directed Investing is recommended for beginners and buy-and-hold investors focusing on the us stock market

- Ally Invest is recommended for investors and traders looking for low fees and focusing on the us market

- Merrill Edge is recommended for investors and traders looking for low fees, quick account opening and simple platforms

- Fidelity is recommended for investors and traders looking for solid research and great trading platforms

Important factors of finding Vanguard alternatives

So far BrokerChooser has reviewed 101 online brokers in detail, which gives this comparison a solid starting point.

Not only that, but all of these brokers are reviewed using the exact same broker review methodology, which makes everything easily comparable. For each broker, we

- open a live account

- check over 100 criteria, with weighting based on readers' preferences

- refresh data regularly

Whether Vanguard or one of its alternatives is the best choice for you is on the following five broker characteristics that most interest people:

Fees. There are different types of fees that your online brokerage may charge, and both the number and the size of these fees may vary significantly from broker to broker. Both of these aspects can impact your returns and your overall experience. Vanguard is one of the cheaper brokers, so if this is an important consideration for you, make sure you pick a similarly low-cost Vanguard alternative.

Deposit/withdrawal. The number of ways that you can deposit or withdraw money to or from your account matters a lot. For example, while you cannot make a deposit with your credit card at Vanguard, some alternatives might allow you to do that.

Web trading platform. While online brokers are usually available on various platforms like mobile apps, tablet apps or desktop software, most people use them through their web platform in a browser. User-friendly trading platforms that offer many different resources can significantly increase your trading comfort.

Markets and products. A lot of people have specific products they would like to invest in. Knowing whether stocks, forex, mutual funds, and other products are available at the given Vanguard alternative is a must.

Now let's dive into the details of how Vanguard and its alternatives perform in the most important areas!

J.P. Morgan Self-Directed Investing

Recommended for beginners and buy-and-hold investors focusing on the US stock market

|

US stock

|

$0.0

|

$0.0

|

|---|

|

Minimum deposit

|

$0

|

$0

|

|---|---|---|

|

Time to open account

|

1 day | 1-3 days |

If you are interested more in J.P. Morgan Self-Directed Investing minimum deposit, this overview will help you.

|

Bank transfer

|

Yes | Yes |

|---|---|---|

|

Credit/debit card

|

No | No |

|

Electronic wallets

|

No | No |

|

Withdrawal fee

|

$0

|

$0

|

|

Web platform score

|

2.9 stars | 3.4 stars |

|---|---|---|

|

Mobile platform score

|

3.9 stars | 4.4 stars |

|

Desktop platform score

|

- | - |

Learn more about J.P. Morgan Self-Directed Investing's web trading platform in the detailed J.P. Morgan Self-Directed Investing review.

|

Stocks

|

Yes | Yes |

|---|---|---|

|

ETFs

|

Yes | Yes |

|

Forex

|

No | No |

|

Funds

|

Yes

|

Yes |

|

Bonds

|

Yes | Yes |

|

Options

|

Yes | Yes |

|

Futures

|

No | No |

|

CFDs

|

No | No |

|

Crypto

|

No | No |

Ally Invest

Recommended for investors and traders looking for low fees and focusing on the US market

|

US stock

|

$0.0

|

$0.0

|

|---|

|

Minimum deposit

|

$0

|

$0

|

|---|---|---|

|

Time to open account

|

1-3 days | 1-3 days |

If you are interested more in Ally Invest minimum deposit, this overview will help you.

|

Bank transfer

|

Yes | Yes |

|---|---|---|

|

Credit/debit card

|

No | No |

|

Electronic wallets

|

No | No |

|

Withdrawal fee

|

$0

|

$0

|

|

Web platform score

|

4.0 stars | 3.4 stars |

|---|---|---|

|

Mobile platform score

|

4.0 stars | 4.4 stars |

|

Desktop platform score

|

- | - |

Learn more about Ally Invest's web trading platform in the detailed Ally Invest review.

|

Stocks

|

Yes | Yes |

|---|---|---|

|

ETFs

|

Yes | Yes |

|

Forex

|

No | No |

|

Funds

|

Yes | Yes |

|

Bonds

|

Yes | Yes |

|

Options

|

Yes | Yes |

|

Futures

|

No | No |

|

CFDs

|

No | No |

|

Crypto

|

No | No |

Merrill Edge

Recommended for investors and traders looking for low fees, quick account opening and simple platforms

|

US stock

|

$0.0

|

$0.0

|

|---|

|

Minimum deposit

|

$0

|

$0

|

|---|---|---|

|

Time to open account

|

1 day | 1-3 days |

If you are interested more in Merrill Edge minimum deposit, this overview will help you.

|

Bank transfer

|

Yes | Yes |

|---|---|---|

|

Credit/debit card

|

No | No |

|

Electronic wallets

|

No | No |

|

Withdrawal fee

|

$0

|

$0

|

|

Web platform score

|

4.3 stars | 3.4 stars |

|---|---|---|

|

Mobile platform score

|

4.8 stars | 4.4 stars |

|

Desktop platform score

|

4.3 stars | - |

Learn more about Merrill Edge's web trading platform in the detailed Merrill Edge review.

|

Stocks

|

Yes | Yes |

|---|---|---|

|

ETFs

|

Yes | Yes |

|

Forex

|

No | No |

|

Funds

|

Yes | Yes |

|

Bonds

|

Yes | Yes |

|

Options

|

Yes | Yes |

|

Futures

|

No | No |

|

CFDs

|

No | No |

|

Crypto

|

No | No |

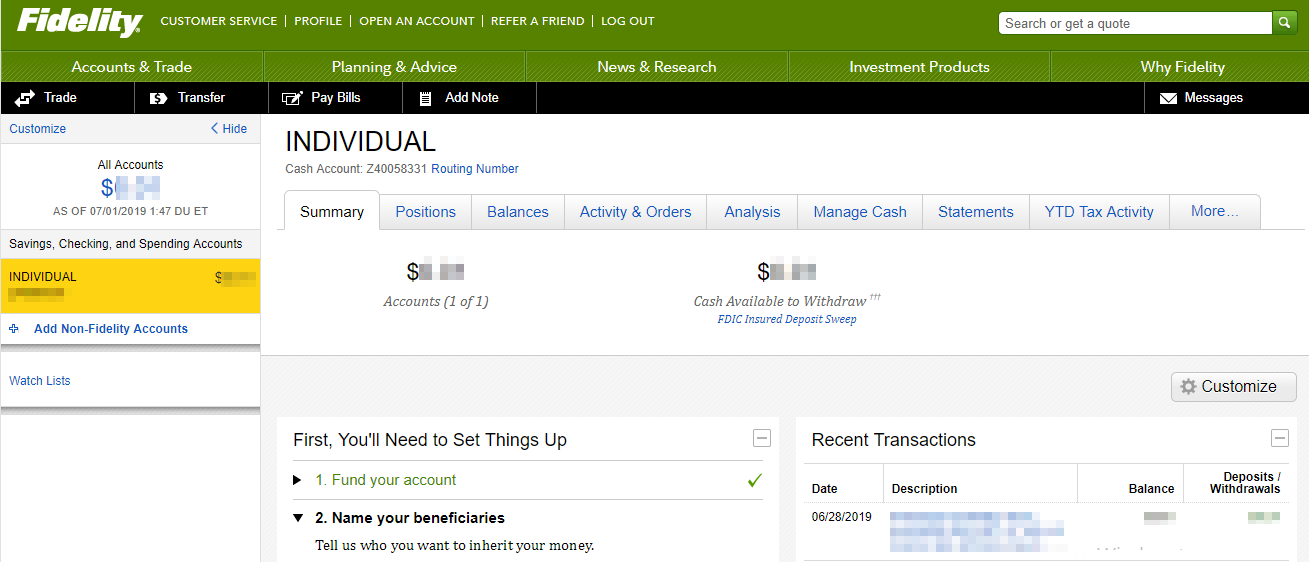

Fidelity

Recommended for investors and traders looking for solid research and great trading platforms

|

US stock

|

$0.0

|

$0.0

|

|---|---|---|

|

UK stock

|

$11.3

|

-

|

|

German stock

|

$20.5

|

-

|

|

Minimum deposit

|

$0

|

$0

|

|---|---|---|

|

Time to open account

|

1-3 days | 1-3 days |

If you are interested more in Fidelity minimum deposit, this overview will help you.

|

Bank transfer

|

Yes | Yes |

|---|---|---|

|

Credit/debit card

|

No | No |

|

Electronic wallets

|

Yes | No |

|

Withdrawal fee

|

$0

|

$0

|

|

Web platform score

|

4.5 stars | 3.4 stars |

|---|---|---|

|

Mobile platform score

|

5.0 stars | 4.4 stars |

|

Desktop platform score

|

4.3 stars | - |

Learn more about Fidelity's web trading platform in the detailed Fidelity review.

|

Stocks

|

Yes | Yes |

|---|---|---|

|

ETFs

|

Yes | Yes |

|

Forex

|

No | No |

|

Funds

|

Yes | Yes |

|

Bonds

|

Yes | Yes |

|

Options

|

Yes | Yes |

|

Futures

|

No | No |

|

CFDs

|

No | No |

|

Crypto

|

Yes

|

No |

Vanguard

Recommended for long-term investors looking for great ETF and mutual fund selection

|

US stock

|

$0.0

|

$0.0

|

$0.0

|

$0.0

|

$0.0

|

|---|

|

Minimum deposit

|

$0

|

$0

|

$0

|

$0

|

$0

|

|---|---|---|---|---|---|

|

Time to open account

|

1-3 days | 1 day | 1-3 days | 1 day | 1-3 days |

Learn more about Vanguard minimum deposit here.

|

Bank transfer

|

Yes | Yes | Yes | Yes | Yes |

|---|---|---|---|---|---|

|

Credit/debit card

|

No | No | No | No | No |

|

Electronic wallets

|

No | No | No | No | Yes |

|

Withdrawal fee

|

$0

|

$0

|

$0

|

$0

|

$0

|

|

Web platform score

|

3.4 stars | 2.9 stars | 4.0 stars | 4.3 stars | 4.5 stars |

|---|---|---|---|---|---|

|

Mobile platform score

|

4.4 stars | 3.9 stars | 4.0 stars | 4.8 stars | 5.0 stars |

|

Desktop platform score

|

- | - | - | 4.3 stars | 4.3 stars |

Learn more about Vanguard's web trading platform in the detailed Vanguard review.

|

Stocks

|

Yes | Yes | Yes | Yes | Yes |

|---|---|---|---|---|---|

|

ETFs

|

Yes | Yes | Yes | Yes | Yes |

|

Forex

|

No | No | No | No | No |

|

Funds

|

Yes |

Yes

|

Yes | Yes | Yes |

|

Bonds

|

Yes | Yes | Yes | Yes | Yes |

|

Options

|

Yes | Yes | Yes | Yes | Yes |

|

Futures

|

No | No | No | No | No |

|

CFDs

|

No | No | No | No | No |

|

Crypto

|

No | No | No | No |

Yes

|

Bottom line

Based on our analysis, there are several good alternatives to Vanguard. They all offer similar products and target similar customers. Here's a recap of the results in a table.

|

Broker intro

|

Recommended for

|

|

|---|---|---|

| US stockbroker | Long-term investors looking for great ETF and mutual fund selection | |

| US-based discount broker | Beginners and buy-and-hold investors focusing on the US stock market | |

| US stockbroker | Investors and traders looking for low fees and focusing on the US market | |

| US discount broker | Investors and traders looking for low fees, quick account opening and simple platforms | |

| US stockbroker | Investors and traders looking for solid research and great trading platforms |

Still unsure? Use our broker finder and find the best broker for you or learn more about investing your money.

Check out this short video for a behind-the-scenes peek into how our experts personally test and evaluate brokers.