Why choose Swissquote

Swissquote is a Swiss online broker with a banking license. It offers access to many markets around the world. It charges no inactivity fee, and as a listed Swiss broker with a banking background, it scores high on safety. It is a good choice for beginner investors.

However, Swissquote has high fees. Its selection of multiple trading platforms is a bit overwhelming, and some of its research tools are not free to use.

BrokerChooser gave Swissquote a 4.4/5 rating based on analyzing 600+ criteria and testing via opening a live account.

- Access to many markets and products

- No inactivity fee

- Rock-solid background

Not sure if this is the right broker for you? See the best ones.

Fees

- Low fund fees

- No inactivity fee

We compared Swissquote's fees with two similar brokers we selected, Saxo Bank and Interactive Brokers. These competitors were selected based on objective factors like products offered, client profile, fee structure, etc. See a more detailed comparison of Swissquote alternatives.

High stock and ETF commission

Swissquote US stock fees are much higher than the industry average. US stock fees are calculated as follows: Volume-tiered commission ranging between $9 and $190

| Broker | US stock |

|---|---|

| Swissquote | $20.0 |

| Saxo Bank | $1.6 |

| Interactive Brokers | $1.0 |

Average FX fees

All fees are built into the spread, so there is no separate commission charged. For example, the EUR/USD spread is 1.6.

| Broker | EURUSD spread | FX commission per lot |

|---|---|---|

| Swissquote | 1.6 | No commission is charged |

| Saxo Bank | 0.8 | No commission is charged |

| Interactive Brokers | 0.2 | Trade value less than $1 billion: 0.2 bps * trade value; min. $2 |

Average options commission

Swissquote US stock index options fees are much higher than the industry average. US stock index options fees are calculated as follows: $1.99 per contract commission with $5 min

| Broker | US stock index options |

|---|---|

| Swissquote | $19.9 |

| Saxo Bank | $20.0 |

| Interactive Brokers | $6.5 |

We calculated the fees for stock index options.

High custody fee, low withdrawal fee

| Broker | Custody fee | Withdrawal fee |

|---|---|---|

| Swissquote | $10 | |

| Saxo Bank | $0 | |

| Interactive Brokers | $0 |

There is no inactivity fee or account maintenance fee at Swissquote Bank (CH), while there is 0.1875% min. €100 per quarter inactivity fee at Swissquote Europe (LUX).

Depositing money is free via bank transfer, but credit/debit card transfers carry a 2.2-2.5% fee. Both Swissquote Bank (CH) and Swissquote Bank (Europe) charges a withdrawal fee.

Swissquote Bank (CH) charges a high custody fee, which is charged after the securities you hold. The fee is 0.025% of total assets per quarter, with a CHF 15 minimum and CHF 50 maximum. Swissquote Bank (Europe) doesn't charge custody fee

Other commissions and fees

Low mutual fund commission: trading mutual funds involves the following charges - $9 per trade from Prime Partners (BlackRock, Fidelity, HSBC, etc.) and $0 per trade for funds under Swissquote's custody.

Average futures fees: US index futures fees are as follows - $1.99 per contract commission with $5 min (E-Mini only).

High spot crypto fees: at Swissquote, crypto trading costs 1% of trade value.

High bond commission: US treasury bonds come with the following charges - 0.3% of trade value with $75 min.

Average margin rates: the USD annual margin rate is 9.6%.

| Broker | Mutual fund | US micro e-mini stock index futures |

|---|---|---|

| Swissquote | $9.0 | $19.9 |

| Saxo Bank | $0.0 | $30.0 |

| Interactive Brokers | $15.0 | $2.5 |

Safety

- Majority of clients belong to a top-tier financial authority

- Banking background

- Listed on stock exchange

Deposit and withdrawal

- Credit/Debit card available

- Several account base currencies

Account opening

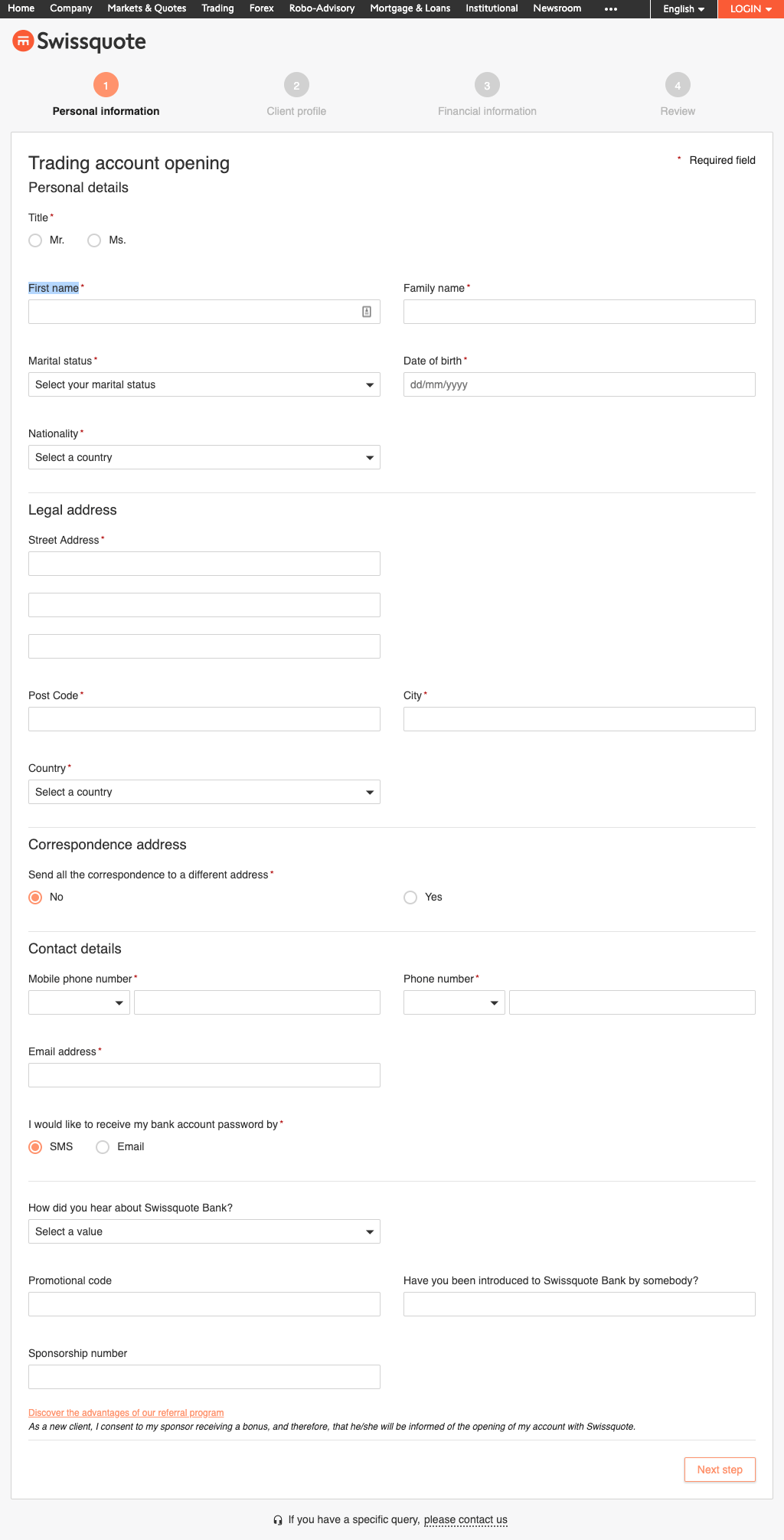

- Fully digital

- No minimum deposit for trading account

Mobile app

- User-friendly

- Good search function

- Price alerts

Desktop platform

- Clear fee report

- Good customizability (for charts, workspace)

- Price alerts